December 2022

How to Address Employee Turnover

Practical ideas for small businesses

We are in the midst of the “Great Resignation.” This is the name being used to describe the mass exodus of people, both young and old and in between, from the workplace. When you combine the development with the trend of “quiet quitting” where employees do the bare minimum of work until they eventually leave, your business may be understaffed for the upcoming year.

How can you reduce employee turnover? Although there are no guarantees, one overall idea is to improve the general work environment. For example, you might address some common concerns of your employees each Friday afternoon. Alternatively, you can try to schedule regular one-on-one meetings or Zoom calls on a monthly or quarterly basis to address employee concerns.

Some of the revelations resulting from these meetings may surprise you. You may find that an employee is bored by the day-to-day routine of a job. Perhaps the level of compensation is an issue. Or maybe you need to spell out better guidelines for job performance. Finally, others may have special problems relating to childcare or other family obligations.

Keeping that in mind, here are several practical suggestions for reducing turnover.

• Offer new challenges. No one wants to be caught in a rut. To avoid this problem, you may emphasize an employee’s strengths by creating new tasks. For instance, an innovative employee may be asked to look into new product development. Therefore, you might have to transfer the worker to a different department or group.

• Sharpen skills through training seminars. These seminars allow workers to expand their duties and identify how their particular talents can best be utilized. If you do not have the resources for in-house sessions, you may be able to arrange for private seminars or courses at a local university.

• Set flexible compensation standards. Obviously, it is easier to retain key employees if you pay them what they are worth. The problem often is rooted in an inflexible company policy. For instance, an employee who puts in extra hours may be frustrated by being tied to the same salary structure as someone who clocks in and out from nine-to-five every day. Result: An employer may have to throw out “the book” on compensation levels.

• Think outside the box. If the salary structure cannot be revised, your company may use other methods of compensation to retain valuable employees. A few examples are deferred compensation packages, stock options, bonuses, additional vacation pay or time off.

• Explain your standards to employees. Of course, a business manager must be able to recognize and appraise the work an employee does. But the responsibilities do not end there. Case in point: Employees should know what is expected of them and what constitutes satisfactory or excellent performance. It may be necessary to write out practical guidelines and discuss them periodically with your staff.

This last idea should be an on-going process that encourages communication between all parties. Otherwise, it could be a waste if employees do not receive any feedback from your discussions.

Eight Last-Minute Tax Strategies

Time is running out fast

Tick, tick, tick. The days left in the year are counting down to a precious few. We have previously covered several year-end tax planning strategies you might use, but here is a reminder about eight “last-minute” possibilities.

1. Charge it! Generally, you can take a current deduction for charitable donations made as late as the last day of the year, including monetary contributions made by credit card. As long as the charge is posted to your account before New Year’s Day, it is deductible in 2022—even if you do not actually pay off the credit card bill until 2023.

2. Harvest capital gains or losses. Remember that capital gains and losses offset each other. Any excess loss can then offset up to $3,000 of ordinary income. Depending on your situation, you may decide to sell securities late in December to realize a tax-valuable gain or loss.

3. Pre-pay your mortgage. If you pay your next monthly mortgage bill before January 1, 2023, you may deduct the qualified interest on your 2022 tax return if you itemize. In effect, you are thereby receiving the benefit of 13 monthly mortgage payments this year. Caveat: You then must pre-pay each succeeding year to avoid dropping down to eleven months’ worth of payments in a subsequent year. Consider all aspects of this technique.

4. Schedule year-end check-ups. The tax law allows you to deduct unreimbursed medical and dental expenses to the extent the annual total exceeds 7.5% of your adjusted gross income (AGI). If you have already cleared the 7.5%-of-AGI threshold for 2022, a routine physical exam or dental cleaning in December may increase your deduction.

5. Set up a Keogh plan. If you are self-employed, you have until your tax return due date for the current year, plus any extensions, to make deductible contributions to a Keogh plan. The deductible contribution limit for 2022 is generally the lesser of 25% of compensation or $61,000 ($67,500 if age 50 or over). Key point: The Keogh plan must be established before January 1, 2023 to qualify for 2022 deductions.

6, Pay your child’s tuition. Generally, you may claim one of two credits—the American Opportunity Tax Credit (AOTC) or the Lifetime Learning credit (LLC)—for amounts paid for a child in college. The maximum AOTC is $2,500 per student; $2,000 per family for the LLC. But the credits are phased out for certain taxpayers. If you still qualify, pay next semester’s tuition in December to increase a credit for 2022.

7. Transfer IRA funds to charity. Under a special tax law provision, you may transfer up to $100,000 directly from an IRA to a qualified charitable organization without paying any tax on the transfer. This tax break applies only to individuals age 70½ or over. Added benefit: This counts as a required minimum distribution (RMD) from your IRA. Failure to take an RMD may result in a hefty penalty.

8. Be generous at the holidays. The annual gift tax exclusion allows you to give each recipient gifts valued at up to $16,000 in 2022 without incurring any gift tax liability. The exclusion is effectively doubled to $32,00 per recipient for gifts by a married couple. Note: The exclusion jumps to $17,000 per recipient in 2023.

Obtain professional tax guidance concerning your situation.

Tax Relief for Business Bad Debts

Secure a deduction at year-end

In this difficult economic environment, some of your clients may have difficulty paying their bills. Others have not fully recovered from the pandemic. As a result, you may have trouble getting paid for your goods or services on time—or even at all.

Saving grace: You may be able to salvage a bad business debt deduction on your 2022 tax return. But this tax treatment is not automatic—far from it. To qualify for tax relief, ramp up your collection efforts before the end of the year.

The rules in this area are complicated, so we will briefly review the basics.

If you are a cash-basis taxpayer, like many self-employed individuals and other small business owners, you are entitled to deduct a business bad debt only if the amount that was owed was previously included in gross income. This applies to amounts owed from all sources of taxable income.

However, if the business operates on the accrual method instead, it generally reports income as it is earned. Thus, the business can claim a bad debt deduction for an uncollected receivable that was previously included in gross income.

Notably, you must establish that the debt is legitimate and cannot be recovered from the debtor. To satisfy this requirement, take steps to secure payment. Although you do not necessarily have to go as far as filing a lawsuit against the debtor, simply reaching out with a single phone call or email is not enough either.

As a general rule, a business will use the specific charge-off method for bad debts. Accordingly, you must identify debts as being partially or completely worthless. Assuming you are using the specific charge-off method, you may deduct those business bad debts that become either partially or totally worthless during the year.

• Partially worthless debts: In this case, the deduction is limited to the amount charged off during the year. You are not required to charge off partially worthless debts annually, so you may delay this until a subsequent year. Caution: You cannot deduct any part of a debt after the year in which it becomes totally worthless.

• Totally worthless debts: If a debt becomes totally worthless in the current tax year, you may deduct the entire amount (less any amount deducted in an earlier tax year when the debt was only partially worthless).

Note: You do not have to make an actual charge-off on your books to claim a bad debt deduction for a totally worthless debt. However, if the IRS then determines that the debt is only partially worthless, you will not be able to deduction a debt in that tax year. Reason: A deduction of a partially worthless bad debt is limited to the amount actually charged off.

Final words: Winter is approaching but spring into action now. Follow through on your previous collection activities. Try to wrap up matters before 2023 to qualify for a deduction for 2022.

Coping With Stock Market Volatility

Riding out the ups and downs

This year has been a wild rollercoaster ride for the stock market. Notably, declines of several hundreds of points in the Dow Jones Industrials Average (DJIA) have become almost routine, as have significant bounce-backs. The economic data and inflation have contributed to the uncertainty, as have other domestic and global events.

And the year is not over yet. Who knows what will happen next or even from the time this is being written to the time you are reading it?

Practical approach: Develop a comprehensive investment plan designed to help smooth out some of the typical ups and downs of the stock market. Following are several “common sense” ideas to consider.

• Plan for the long term. It is tempting to jump on the bandwagon when the bulls are running wild and easy to panic when the bears take over. Do not let emotion rule your investment decisions. Know your time horizon and develop a plan that emphasizes your long-term goals…and then stick to it.

• Do not ignore liquidity needs. On the other hand, you may not be able to invest the bulk of your assets in equities over the long term if you need some of the money to pay for daily expenses. This may include outlays for the monthly mortgage, a child’s education or health and life insurance. Make sure you are liquid enough to live comfortably without tying up all your cash.

• Stick to the investment fundamentals. Of course, there are no absolute guarantees, but the tried-and-true principles of asset allocation and diversification are worthy of your consideration. By finding the proper balance of assets for your portfolio, and classes within those assets, you are far more likely to avoid any dire consequences. At the very least, do not put all of your eggs into any one basket.

• Think international. The days of limiting yourself to domestic equities are long gone for astute investors. In this global economy, it only makes sense to include assets from foreign countries in the mix. This is a variation on the theme of asset allocation mentioned above. Naturally, you can apply the same economic analysis for foreign investments as you do for U.S.-based equities.

• Educate yourself. The more you understand about how the markets work, and what makes them move up or down, the more you will be able to tolerate the inevitable swings. Read everything you need to know about a particular investment before you buy or sell it. Surprisingly, many investors will own stocks or bonds or other assets without really knowing what they are.

There is no need to be scared by the inherent volatility in equities nor should you overreact when the market turns in your favor. The start of a new year is a good time to review your portfolio and make any necessary adjustments. Do not hesitate to seek professional guidance relating to your investments and potential tax consequences.

IRS Hikes Retirement Plan Limits

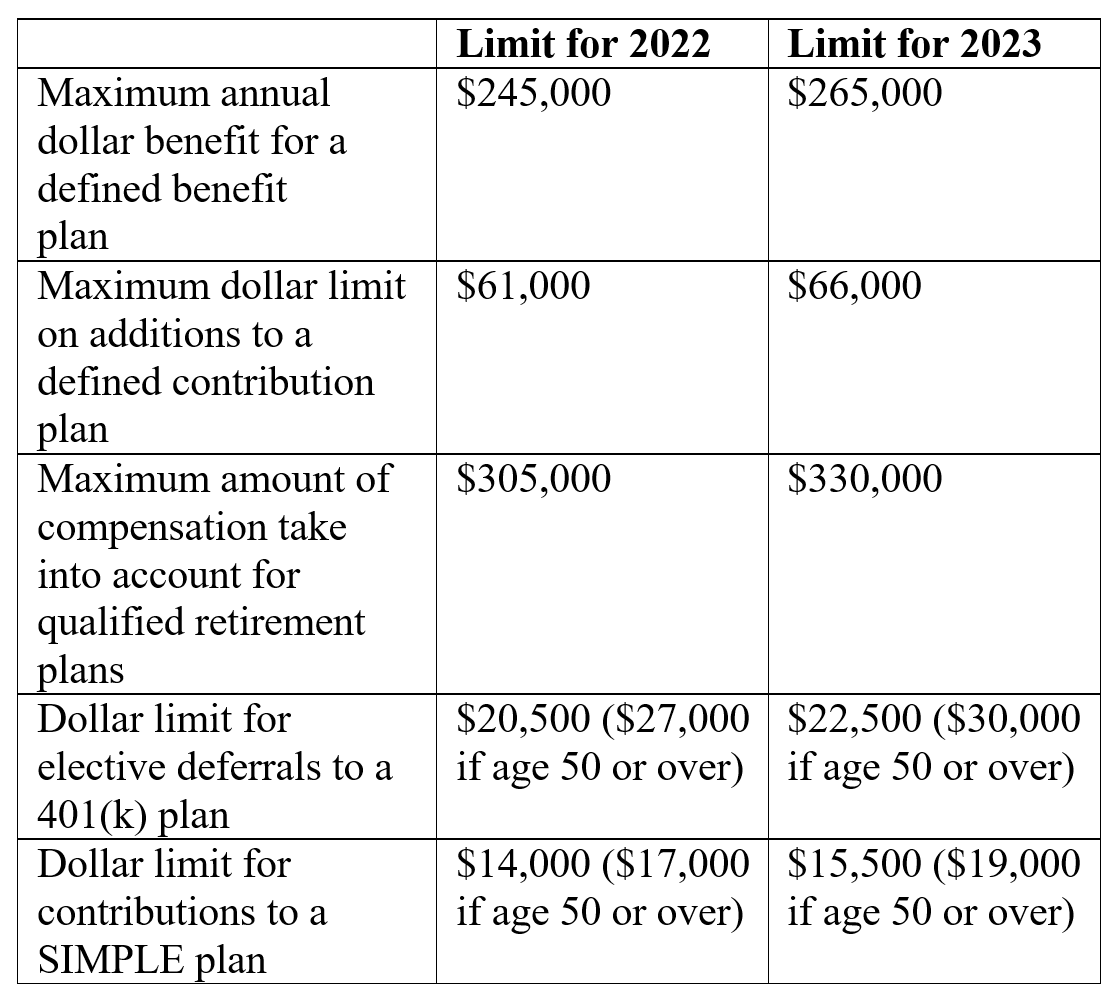

The IRS recently announced cost-of-living adjustments (COLAs) for certain retirement plans in 2023. Due to rising inflation, the increases are greater than usual, as shown below. For instance, the limit for 401(k) plan contributions jumps by $2,000.

Note: The annual limit for contributions to traditional and Roth IRAs is also increasing from $6,000 for 2022 ($7,000 if you age 50 or over) to $6,500 for 2023 ($7,500 if age 50 or over). The phase-out levels for IRA and Roth contributions have also been adjusted upward.

Facts and Figures

Timely points of particular interest

Rising Wage Base-Buckle up, the Social Security wage base will much be higher next year. The Social Security Administration (SSA) has announced that the wage base for purposes of the 6.2% Social Security ase—portion of federal payroll tax is increasing to $160,200 in 2023, up from $147,000 in 2022. That is a precipitous hike of $13,200. The 1.45% Medicare portion of federal payroll tax continues to apply to all wages earned during the year.

Earnings Test-The “earnings test” for Social Security benefits is also going up significantly. For those attaining normal retirement age (NRA) after 2023, the threshold in 2023 is $21,240, up from $19,560. They lose $1 of benefits for every $2 of earnings above the limit. For those attaining NRA in 2023, the threshold is $56,520, up from $51,960. (This only applies to earnings in months prior to attaining NRA.) They lose $1 of benefits for every $3 over the limit.